Your credit score is more than just a number — it’s a key to financial opportunities. Whether you’re planning to buy a home, lease a car, or qualify for a premium credit card, your score determines how lenders view your reliability.

Many people think improving credit takes years. The truth? With the right strategy, you can start seeing results in as little as three months. The secret lies in understanding how your score is calculated and taking targeted actions to fix weak areas.

Here’s how to give your credit score a fast, effective boost — without falling for gimmicks or risky shortcuts.

Understanding How Credit Scores Work

Most lenders in the U.S. use the FICO® Score, which ranges from 300 to 850. The higher the number, the better your credit health. The score is based on five key factors:

- Payment History (35%) – Paying bills on time is the single most important factor.

- Credit Utilization (30%) – The percentage of your available credit that you’re using.

- Length of Credit History (15%) – How long you’ve had credit accounts open.

- Credit Mix (10%) – A healthy combination of credit types, like cards, loans, and retail accounts.

- New Credit (10%) – How often you apply for new accounts and the number of recent inquiries.

Knowing this breakdown helps you prioritize actions that create the biggest improvements in the shortest time.

Month 1: Review and Repair

1. Get Your Credit Reports

Start by obtaining your free credit reports from the three major bureaus — Experian, Equifax, and TransUnion. Review them carefully for errors such as duplicate accounts, incorrect balances, or outdated late payments.

2. Dispute Any Inaccuracies

Even small mistakes can lower your score. File disputes online or by mail with the credit bureaus. Most errors are investigated and resolved within 30 days, and successful corrections can lead to a noticeable score bump.

3. Set Up Payment Reminders

Late payments can stay on your record for years. Use automatic payments or reminders to ensure all bills are paid on time. One or two months of consistent on-time payments can begin to offset prior issues.

4. Catch Up on Delinquencies

If you have accounts in arrears, contact your creditors and negotiate a repayment plan. Paying off or bringing delinquent accounts current shows lenders that you’re regaining control of your finances.

Month 2: Optimize Your Credit Utilization

1. Pay Down Balances Strategically

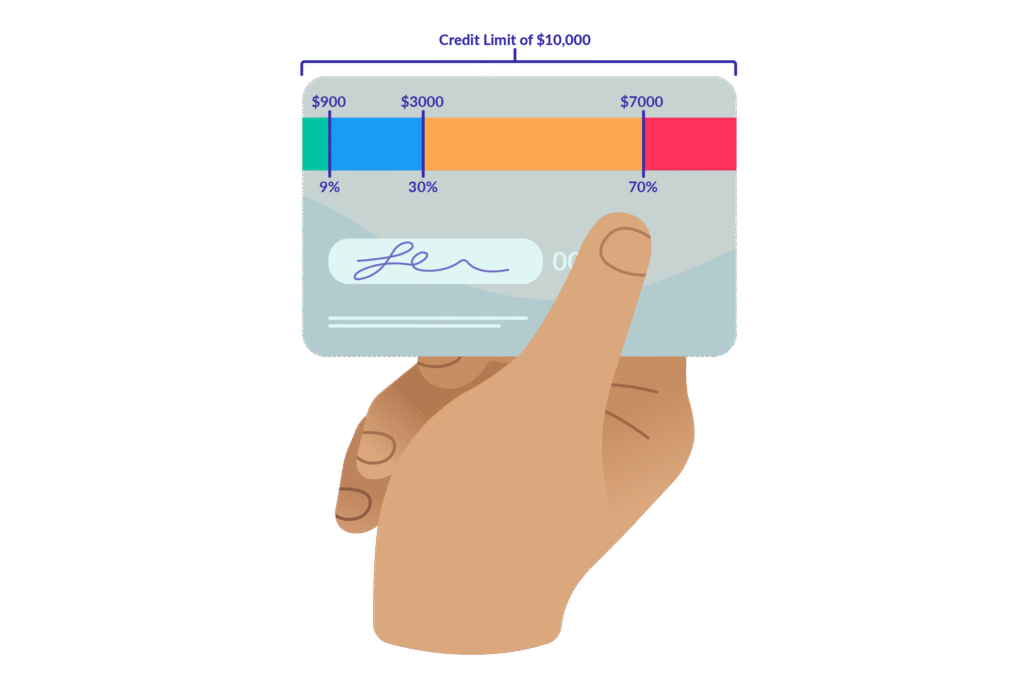

Your credit utilization ratio — the amount of credit you’re using compared to your total limit — is the second-most influential factor in your score. Try to keep your utilization below 30%, and ideally around 10%.

If you carry balances on multiple cards, focus on paying down the one with the highest utilization first. Even reducing balances slightly can yield a quick improvement.

2. Ask for a Credit Limit Increase

If you have a positive payment history, request a higher credit limit from your credit card issuer. This immediately lowers your utilization ratio — as long as you don’t increase your spending.

3. Avoid Closing Old Accounts

Closing older credit cards can shorten your credit history and raise your utilization ratio. Keep old accounts open, even if you don’t use them regularly, unless they charge high annual fees.

4. Become an Authorized User

If a family member or friend with excellent credit adds you as an authorized user on their account, their positive payment history can help strengthen your credit profile.

Month 3: Build and Diversify

1. Use a Secured Credit Card or Credit Builder Loan

If you have limited or damaged credit, a secured credit card — backed by a cash deposit — allows you to build positive history safely. Make small purchases and pay the balance in full each month. Similarly, a credit-builder loan helps establish a steady record of payments.

2. Keep New Applications Minimal

Each new credit inquiry can lower your score temporarily. In the short term, avoid applying for multiple cards or loans unless absolutely necessary.

3. Continue Paying On Time — Every Time

After two to three months of consistent on-time payments, your credit report will start reflecting improved reliability. This simple habit has the most lasting impact on your score.

4. Monitor Your Progress

Use free tools offered by banks or credit apps to track changes in your score weekly. Seeing your progress keeps you motivated and helps identify patterns that affect your results.

Additional Quick Tips

- Pay Twice a Month: If you can, make payments before your statement closes to reduce reported balances.

- Negotiate to Remove Old Late Payments: Some creditors may agree to a “goodwill adjustment” if you’ve since been a reliable customer.

- Automate Everything: Automatic payments ensure you never miss a due date — essential for long-term improvement.

- Don’t Overreact to Small Drops: Scores fluctuate naturally. Focus on consistent positive actions over time.

The Results You Can Expect

If you follow these steps consistently, most people can raise their credit score by 50 to 100 points within three months, depending on their starting point. The greatest improvements typically come from lowering utilization and fixing errors.

Remember, credit repair is a journey, not a quick fix. The same habits that improve your score quickly — timely payments, low balances, and responsible credit use — are what sustain it long-term.

By month three, you’ll likely notice tangible results: better credit card offers, lower loan rates, and greater financial flexibility. With continued discipline, your credit score will continue to rise, opening doors to even more opportunities.

Final Thoughts

Improving your credit score in under three months is absolutely possible. The key is consistency and focus:

- Pay every bill on time.

- Keep balances low.

- Fix errors immediately.

- Avoid unnecessary new credit.

Credit is not just about access — it’s about financial reputation. By showing lenders you’re responsible and proactive, you can turn your credit around faster than you might think.

A strong credit score doesn’t just make borrowing easier — it saves you money on interest, boosts your financial confidence, and strengthens your foundation for the future. Start today, and in three months, you’ll thank yourself.