Debt can feel like an uphill battle — a mix of stress, frustration, and endless payments. Whether it’s credit cards, student loans, or car payments, getting out of debt can seem impossible at first. But there’s a simple, highly effective strategy that’s helped thousands of people take control of their finances: the Snowball Method.

Unlike complicated financial plans or strict budgeting systems, the Snowball Method focuses on momentum — using small, early wins to keep you motivated and moving forward. Let’s explore how it works, why it’s so effective, and how to make it work for you.

1. Understanding the Snowball Method

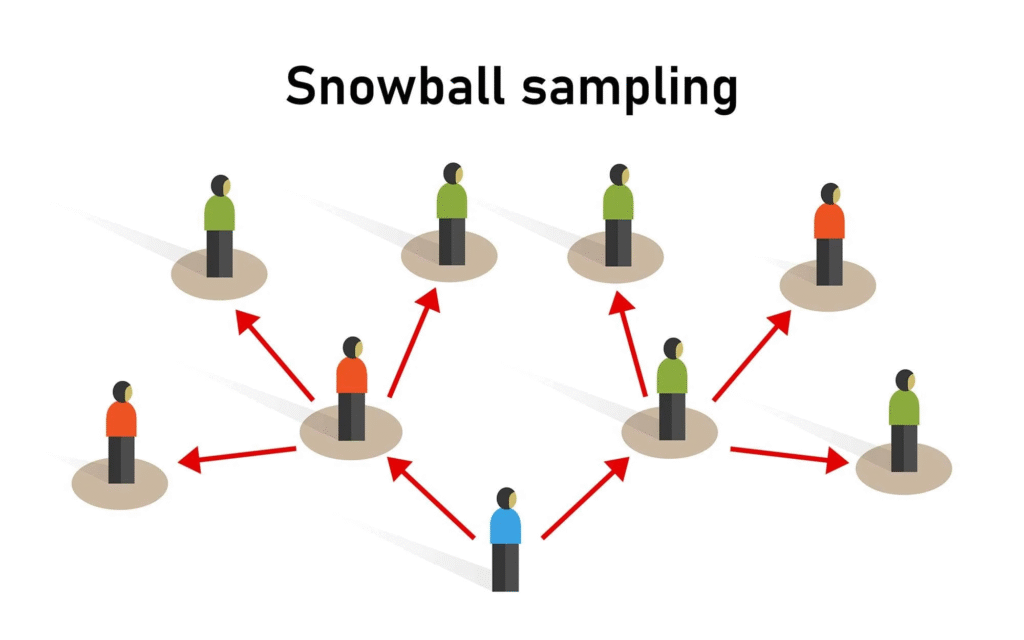

The Snowball Method was popularized by personal finance expert Dave Ramsey, and it’s based on one simple idea:

Pay off your smallest debt first, regardless of the interest rate, while making minimum payments on all others.

Once that smallest debt is gone, take the amount you were paying on it and apply it to the next smallest balance.

As each debt disappears, the amount of money you can put toward the next one grows — just like a snowball rolling downhill, gaining size and speed as it moves.

Here’s what makes it powerful: it’s not just about math — it’s about motivation. When you see progress quickly, you build confidence and energy to keep going until you’re debt-free.

2. Step-by-Step Guide to Using the Snowball Method

Let’s break the process into clear, actionable steps:

Step 1: List All Your Debts

Write down every debt you owe, including:

- Credit cards

- Student loans

- Car loans

- Personal loans

- Medical bills

Record the balance, minimum payment, and interest rate for each.

Step 2: Order Debts by Balance (Smallest to Largest)

Ignore interest rates for now. Order your debts from smallest to largest balance — even if a larger one has a higher rate.

For example:

- Credit card #1 — $400

- Medical bill — $1,200

- Car loan — $6,000

- Student loan — $15,000

Step 3: Focus on the Smallest Debt

Pay as much as you can toward the smallest debt while continuing to make minimum payments on the rest.

If you can cut expenses or boost income temporarily, direct every extra dollar to that smallest balance.

Step 4: Celebrate the Win

When you pay off that first debt, take a moment to celebrate — seriously. It’s proof that your plan works.

Then, take the total amount you were paying on that first debt (the minimum plus any extra) and roll it into payments on the next one.

Step 5: Repeat Until You’re Debt-Free

Continue the process, snowballing your payments as each debt is eliminated. Over time, your payment power grows, and your debt shrinks faster with each step.

3. Why the Snowball Method Works

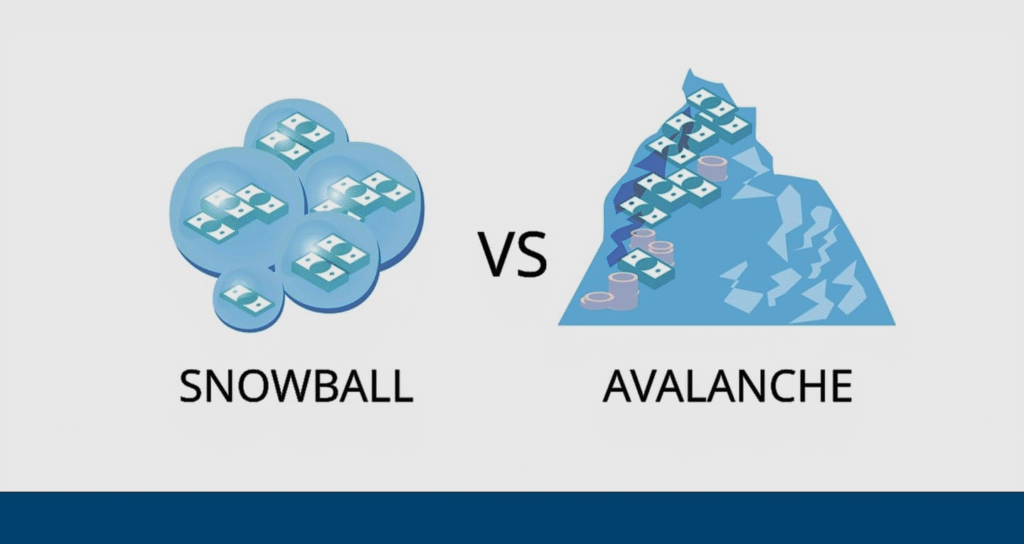

At first glance, it may seem smarter to pay off debts with the highest interest rate first (known as the avalanche method). While that’s mathematically sound, the Snowball Method often leads to better long-term success because it builds momentum and motivation.

Here’s why it works so well:

- Quick wins keep you motivated. Paying off even a small $300 debt feels like progress — and progress fuels persistence.

- It simplifies your strategy. You focus on one debt at a time, reducing overwhelm.

- Psychological rewards matter. The satisfaction of seeing debts disappear helps you stay disciplined.

In personal finance, behavior often beats pure logic. The Snowball Method keeps you emotionally invested in the process — and that’s the key to staying consistent.

4. Tips to Maximize the Snowball Method’s Power

To make the most of your debt snowball, use these smart strategies:

a. Free Up Extra Cash

Review your budget to find small savings. Even $100 a month can make a difference. Cut unused subscriptions, reduce dining out, or sell items you no longer need.

b. Avoid Taking on New Debt

As you work through your plan, commit to avoiding new debt. Otherwise, it’s like trying to run uphill while adding weights.

c. Track Your Progress Visually

Create a chart or spreadsheet showing each debt and your payoff progress. Visual reminders reinforce motivation and make success feel tangible.

d. Use Windfalls Wisely

Tax refunds, bonuses, or side income can give your snowball a major boost. Apply these directly to your smallest debt to accelerate momentum.

e. Stay Consistent

The power of the Snowball Method comes from steady, consistent effort. Even small extra payments add up over time.

5. Snowball vs. Avalanche: Which Is Better for You?

While the Avalanche Method (paying highest-interest debt first) may save more money over time, the Snowball Method often leads to higher completion rates.

Choose the Snowball Method if you:

- Need motivation and visible progress

- Feel overwhelmed by multiple debts

- Want a simple, easy-to-follow plan

Choose the Avalanche Method if you:

- Have high-interest debt (like credit cards above 20%)

- Are highly disciplined and don’t need emotional rewards

In many cases, people start with the Snowball Method to gain momentum — and switch to the Avalanche Method later once they’re confident.

6. The Emotional Payoff

Becoming debt-free isn’t just about numbers — it’s about freedom. It means less stress, more flexibility, and the ability to focus on goals like saving, investing, or traveling.

Each time you eliminate a debt, you gain more control over your financial future. The process builds not just wealth, but confidence.

And when that final payment clears, it’s not just the end of debt — it’s the beginning of a new chapter.

7. Final Thoughts: Build Momentum and Don’t Stop

The Snowball Method works because it transforms something intimidating into something manageable. By focusing on one step at a time, you create small victories that grow into lasting success.

Debt freedom rarely happens overnight, but with consistency, discipline, and momentum, it’s absolutely achievable.

So grab your list, choose your smallest balance, and make that first payment. The snowball starts small — but with every roll, it gains unstoppable power.