In an era of market volatility and rising interest rates, dividend stocks continue to attract investors seeking stable, long-term income. For U.S. investors in 2025, dividends remain one of the most reliable ways to generate passive cash flow while also benefiting from potential capital appreciation.

Whether you’re building a retirement portfolio or simply want predictable returns, choosing the right dividend-paying companies can provide a powerful combination of stability, growth, and compounding. Below are ten dividend stocks that stand out in 2025 for their consistency, fundamentals, and income potential.

1. Johnson & Johnson (JNJ)

Dividend Yield: ~3.2%

Why it’s a top pick:

Johnson & Johnson remains a cornerstone of dividend investing. With more than 60 consecutive years of dividend increases, J&J is a true Dividend King. Despite challenges in its consumer health division, the company’s strong pharmaceutical and medical device segments continue to deliver steady cash flows. For investors seeking resilience, few companies match J&J’s financial discipline.

2. Procter & Gamble (PG)

Dividend Yield: ~2.6%

P&G is another dividend aristocrat known for reliability. The maker of Tide, Gillette, and Pampers has demonstrated pricing power even in inflationary environments. Its diversified product portfolio and global reach ensure predictable earnings growth. P&G’s focus on efficiency and cost control supports sustainable dividend increases year after year.

3. PepsiCo (PEP)

Dividend Yield: ~2.9%

PepsiCo’s combination of snack and beverage brands provides both stability and growth. With 52 consecutive years of dividend hikes, the company continues to generate consistent free cash flow. Beyond soda, its Frito-Lay and Quaker brands help balance the business during changing consumer trends. For conservative investors, PepsiCo offers a near-perfect blend of safety and moderate growth.

4. Chevron Corporation (CVX)

Dividend Yield: ~4.0%

Energy stocks remain a solid option for income seekers, and Chevron stands at the forefront. With disciplined capital management and strong free cash flow generation, Chevron has increased its dividend for 37 consecutive years. As oil markets stabilize, the company’s commitment to shareholder returns and share buybacks makes it one of the most attractive dividend plays in the energy sector.

5. JPMorgan Chase & Co. (JPM)

Dividend Yield: ~2.8%

As the largest U.S. bank, JPMorgan combines stability, profitability, and strong capital reserves. Rising interest rates have boosted its net interest income, while the company continues to return capital through consistent dividends and buybacks. CEO Jamie Dimon’s conservative management approach has made JPM a reliable long-term dividend payer, even during market turbulence.

6. Realty Income (O)

Dividend Yield: ~5.5%

Known as “The Monthly Dividend Company,” Realty Income is a REIT (Real Estate Investment Trust) that pays investors every month instead of quarterly. The firm owns thousands of commercial properties under long-term leases with stable tenants like Walgreens and Dollar General. With over 25 years of consecutive dividend increases, Realty Income remains a top choice for those seeking dependable monthly income.

7. AbbVie Inc. (ABBV)

Dividend Yield: ~3.7%

AbbVie’s strong pharmaceutical pipeline and consistent cash generation make it one of the most attractive healthcare dividend stocks. The company has successfully diversified beyond Humira with drugs like Skyrizi and Rinvoq driving future growth. AbbVie’s dividend growth history and robust earnings make it a cornerstone for income-focused investors.

8. Verizon Communications (VZ)

Dividend Yield: ~6.5%

Telecom companies often provide reliable dividends, and Verizon is among the leaders. Despite slow stock performance in recent years, its cash flow remains strong. The company’s heavy 5G investments are starting to pay off, and its generous yield makes it appealing for income investors willing to trade growth for stability.

9. Coca-Cola (KO)

Dividend Yield: ~3.1%

Coca-Cola’s global brand power and pricing flexibility make it a timeless dividend stock. The company has increased its dividend for 62 straight years—an impressive record of resilience through wars, recessions, and pandemics. KO’s steady growth in emerging markets and expanding product portfolio reinforce its reputation as a defensive income generator.

10. Microsoft (MSFT)

Dividend Yield: ~0.8%

While Microsoft’s yield is modest, its growth potential makes it a unique addition to any dividend portfolio. With enormous cash reserves and consistent double-digit earnings growth, the company continues to raise dividends while leading in cloud computing and AI. For those seeking a mix of innovation and income, Microsoft represents the modern face of dividend growth investing.

Why Dividend Investing Still Works in 2025

Dividend investing remains one of the most effective strategies for generating passive income—especially when reinvested. Companies that pay and grow dividends tend to be financially healthy, disciplined, and focused on long-term shareholder value.

With inflation moderating and interest rates expected to decline, dividend yields look increasingly attractive compared to bonds and savings accounts. Reinvesting those dividends compounds returns, creating a snowball effect that can significantly enhance long-term wealth.

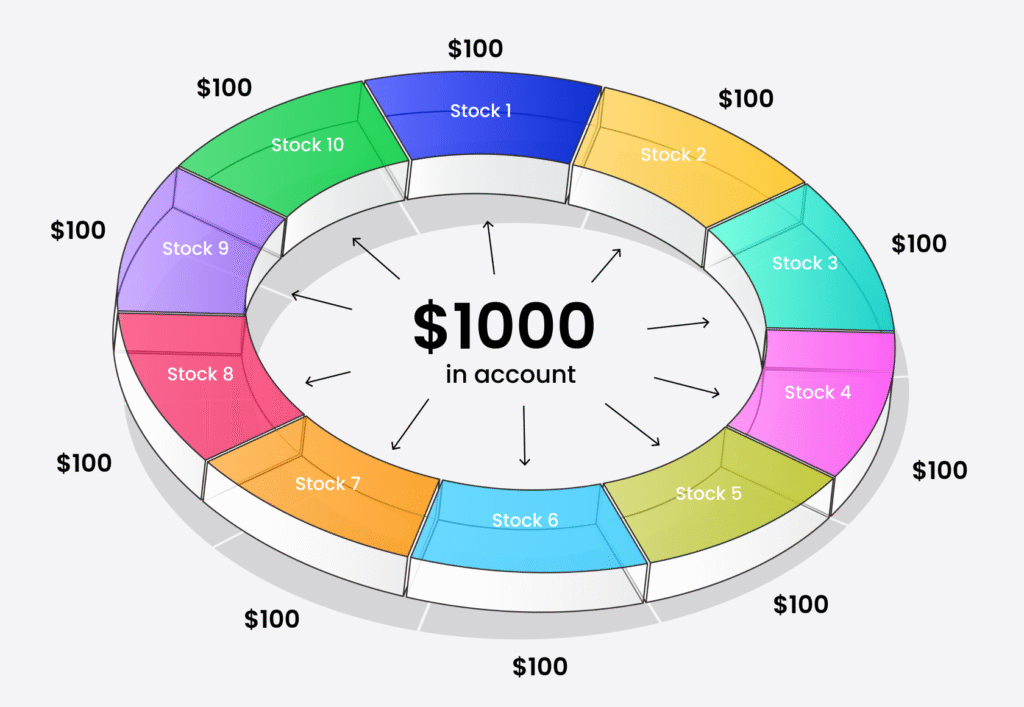

Building a Balanced Dividend Portfolio

When constructing a dividend portfolio, diversification is key. Combine:

- Defensive stocks (like P&G or Coca-Cola) for stability,

- Growth-oriented dividend payers (like Microsoft or AbbVie) for upside potential,

- High-yield plays (like Realty Income or Verizon) for immediate income.

Balance ensures your portfolio performs well across economic cycles while providing consistent cash flow.

Final Thoughts

Investing in dividend stocks isn’t just about chasing the highest yield—it’s about selecting companies with solid balance sheets, sustainable payout ratios, and long-term growth prospects. The best dividend portfolios combine quality, consistency, and patience.

In 2025, the U.S. market offers no shortage of opportunities to build lasting wealth through dividends. Whether you’re just starting or optimizing an existing portfolio, these ten stocks provide a strong foundation for generating passive income and financial freedom.