The United States is experiencing one of the most dynamic and complex energy transformations in its history. Once heavily dependent on foreign oil, the country has become a global energy powerhouse—producing record amounts of oil and natural gas while simultaneously leading innovation in renewable technologies like wind, solar, and battery storage. This dual reality has created both challenges and opportunities for investors seeking to benefit from America’s ongoing energy boom.

A New Era of U.S. Energy Dominance

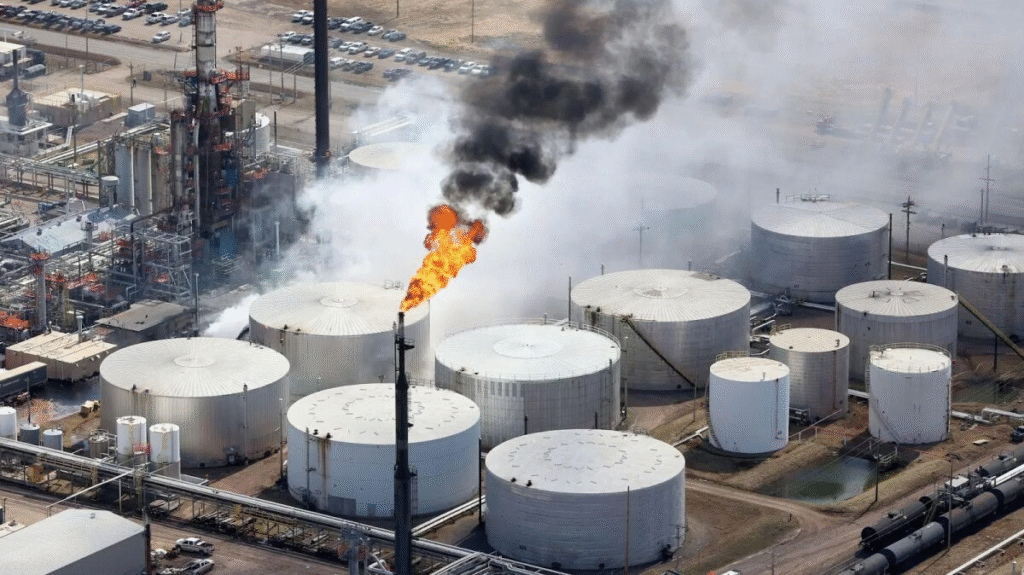

Over the past decade, the U.S. has undergone a dramatic shift from energy importer to exporter. The shale revolution, driven by advances in hydraulic fracturing (“fracking”) and horizontal drilling, unlocked vast reserves of oil and natural gas from formations once considered uneconomical. By 2023, the U.S. became the world’s largest producer of oil and liquefied natural gas (LNG), exporting to markets in Europe and Asia that once relied on OPEC or Russia.

This transformation has reshaped global energy markets. American producers are no longer just price takers—they are now major players influencing global supply, prices, and even geopolitics. When oil prices rise due to conflict or supply disruptions, increased U.S. output can help stabilize markets. Conversely, periods of oversupply or efficiency gains can pressure prices, affecting both domestic producers and investors.

The Case for Oil and Gas Investments

Despite the global push toward decarbonization, fossil fuels continue to play a central role in the world economy. Oil still powers 90% of the transportation sector, while natural gas remains essential for electricity generation and industrial processes. According to the U.S. Energy Information Administration (EIA), demand for oil and gas is expected to remain robust through the 2030s, especially in emerging markets.

For investors, this means that energy companies—particularly those with strong balance sheets, efficient operations, and diversified portfolios—continue to offer value. Major integrated firms like ExxonMobil and Chevron have invested heavily in cost-reducing technologies and low-carbon initiatives, positioning themselves for resilience in a volatile market.

Meanwhile, smaller exploration and production (E&P) companies can offer higher growth potential, albeit with more risk. Investors should focus on firms with low debt, efficient wells, and assets in high-yield regions like the Permian Basin, which remains one of the most productive oil fields in the world.

Midstream companies—those involved in pipelines, storage, and transportation—are another attractive segment. These firms often generate steady cash flows through long-term contracts, making them appealing to income-focused investors, especially as infrastructure expansion supports record export levels.

Natural Gas: The Bridge Fuel

Natural gas has emerged as a “bridge fuel” between fossil fuels and renewables. It emits about 50% less carbon dioxide than coal and provides reliable backup power when wind or solar generation dips. The surge in U.S. LNG exports has also become a strategic asset, helping allies in Europe and Asia diversify away from Russian gas.

As the global LNG market grows, U.S. exporters like Cheniere Energy and newer players developing terminals along the Gulf Coast stand to benefit. These projects require massive capital investment, but rising global demand and long-term contracts can offer predictable returns for patient investors.

In addition, domestic demand for gas is expanding due to its role in powering data centers, supporting manufacturing, and producing hydrogen—another energy source poised for growth in the next decade.

The Rise of Renewables

While fossil fuels remain dominant, renewable energy is no longer a niche market—it’s a core driver of future growth. Government incentives, technological innovation, and corporate sustainability goals are accelerating the adoption of clean energy.

The Inflation Reduction Act (IRA) of 2022 marked a watershed moment for renewable investment in the U.S., offering hundreds of billions in tax credits for solar, wind, and battery projects. This has unleashed a wave of capital into clean energy infrastructure, electric vehicle (EV) manufacturing, and grid modernization.

For investors, the renewables sector offers diverse opportunities:

- Solar Energy: U.S. solar installations are projected to double by 2030. Companies specializing in utility-scale projects and advanced panel manufacturing—such as First Solar—are positioned to benefit.

- Wind Power: Onshore and offshore wind projects are expanding rapidly, particularly along the Atlantic coast. Turbine manufacturers, developers, and maintenance firms offer exposure to this growing segment.

- Energy Storage: As renewable penetration rises, the need for large-scale battery storage increases. Lithium producers, battery manufacturers, and companies developing grid storage technologies could experience strong long-term demand.

The Energy Transition: Conflict or Convergence?

A central question for investors is whether traditional and renewable energy sectors are competitors or complements. In reality, the U.S. energy landscape is evolving into a hybrid system—where oil and gas fund innovation, while renewables drive sustainability and resilience.

Major energy companies are diversifying their portfolios to reflect this reality. BP, Shell, and TotalEnergies, for instance, have invested heavily in wind farms, solar projects, and EV charging networks. U.S. firms have been slower to pivot, but growing regulatory and shareholder pressure is accelerating their clean energy strategies.

For investors, this convergence means it’s no longer necessary to choose between fossil fuels and renewables. A balanced energy portfolio—combining traditional producers with emerging clean technologies—can capture both near-term cash flow and long-term growth.

Risks and Considerations

The energy sector remains cyclical and heavily influenced by global events. Geopolitical tensions, policy changes, and commodity price swings can significantly affect returns. Environmental, social, and governance (ESG) considerations are also increasingly important, as companies face stricter emissions regulations and investor scrutiny.

Interest rates and inflation can impact capital-intensive renewable projects, while oversupply or demand shocks can pressure oil and gas prices. To mitigate these risks, diversification—both across energy sub-sectors and asset types—is essential. Exchange-traded funds (ETFs) such as XLE (Energy Select Sector SPDR Fund) or ICLN (iShares Global Clean Energy ETF) can offer balanced exposure.

The Road Ahead

America’s energy boom is far from over—it’s simply evolving. Oil and gas will remain vital for decades, but the nation’s commitment to clean energy innovation ensures that renewables will play an ever-expanding role in powering growth.

For investors, the message is clear: the energy transition is not a zero-sum game. By embracing both sides of the energy spectrum, investors can participate in the resilience of fossil fuels and the momentum of renewables. The challenge—and the opportunity—lies in striking the right balance between stability and transformation in this new era of American energy leadership.