In 2025, real estate remains one of the most reliable paths to building wealth — but that doesn’t mean you need a fortune to get started. Thanks to technology, fractional ownership, and creative financing, you can start a real estate side business with less than $5,000.

This isn’t a get-rich-quick scheme; it’s about leveraging modern tools and smart strategies to turn limited capital into consistent income and long-term growth. Whether you’re a student, a full-time worker, or simply looking for a second income stream, this guide will show you exactly how to begin.

1. Understanding the Opportunity

For decades, traditional real estate investing required large down payments, strong credit, and plenty of cash reserves.

But in 2025, the industry has evolved.

With new digital platforms, peer-to-peer lending, and REIT access, you can start investing in property-related assets with small amounts of capital — often directly from your phone.

Even if $5,000 won’t buy a property outright, it can help you build ownership, cash flow, and experience, all of which can be scaled over time.

2. Step One: Set a Clear Investment Goal

Before diving in, ask yourself:

- Do I want monthly income (cash flow)?

- Do I want long-term growth (equity)?

- Do I want diversified exposure to real estate without managing tenants?

Your answer determines the best path. For example, if you want passive income, REITs or crowdfunding platforms may fit best. If you want hands-on experience, small rental partnerships or property management could be smarter.

3. Strategy 1: Invest Through Real Estate Crowdfunding Platforms

Platforms like Fundrise, Arrived Homes, and RealtyMogul have transformed access to property investments.

They allow you to invest as little as $10 to $100 in fractional shares of residential or commercial properties.

Your money is pooled with other investors to buy and manage real estate professionally — and you receive regular returns.

Benefits:

✅ Diversification — you can own small pieces of multiple properties

✅ Passive income — you earn from rent and appreciation

✅ No need to manage tenants or maintenance

Estimated returns: 6–12% annually (depending on market conditions and property type).

What you need:

- Minimum investment: $10–$500

- A simple account setup (like a brokerage)

- A long-term mindset — most platforms recommend holding for 3–5 years

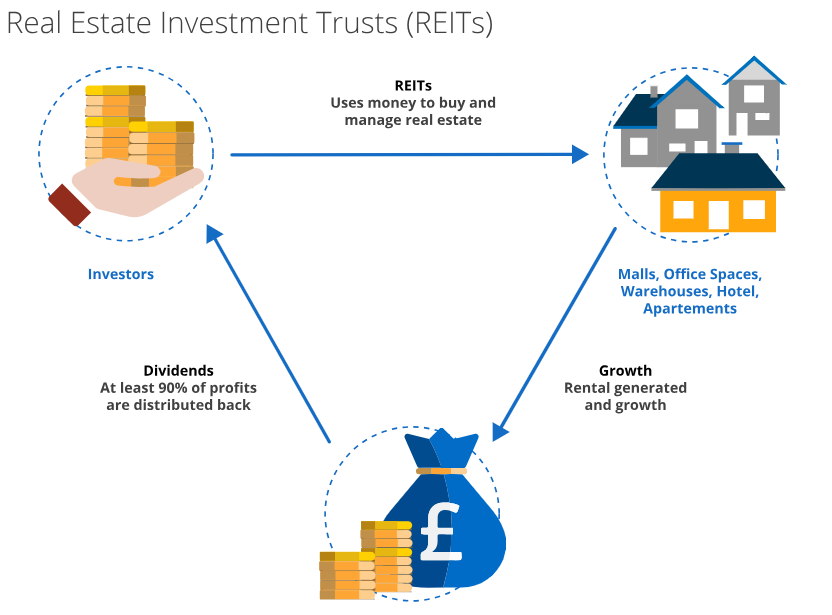

4. Strategy 2: Buy REITs (Real Estate Investment Trusts)

A REIT is a company that owns or finances income-producing real estate — like apartments, data centers, warehouses, or retail buildings.

You can buy REITs directly through a brokerage like Fidelity, Robinhood, or Charles Schwab, even with small amounts.

Why REITs make sense for beginners:

- They pay dividends (usually 4–8% annually)

- They’re liquid — you can buy or sell anytime

- No landlord duties or large upfront investment

Example REITs to explore:

- VNQ (Vanguard Real Estate ETF) – diversified U.S. exposure

- O (Realty Income Corp) – focuses on commercial leases

- AMT (American Tower) – invests in wireless tower infrastructure

With $5,000, you can create a mini real estate portfolio that mirrors the stability of the market — without owning physical property.

5. Strategy 3: Start a Real Estate Service Business

If you prefer something more active, consider starting a side business that supports real estate rather than buying it directly.

Here are several low-cost ideas you can launch for under $5,000:

- 🏠 Property Photography: Realtors and landlords always need professional photos. A used DSLR camera and marketing website can get you started.

- 🧹 Property Cleaning or Turnover Services: With Airbnb and short-term rentals booming, cleaning services are in high demand.

- 🛠️ Property Maintenance Coordination: Act as a middleman connecting landlords with local contractors.

- 📈 Real Estate Marketing Consulting: Help small landlords advertise on Zillow, Facebook, or Airbnb.

Each of these can start part-time and scale as your client base grows — turning into a full-fledged business.

6. Strategy 4: Partner in Small Real Estate Deals

If you have a trusted network, partnering is a powerful way to start small.

For example:

- You contribute $5,000 as partial funding for a down payment.

- Your partner handles financing or property management.

- Profits (rent or appreciation) are split proportionally.

Platforms like EquityMultiple or Groundfloor also allow micro-participation in larger deals, where your money helps fund renovations or short-term flips.

Caution: Only partner with people you trust and always use a written agreement.

7. Strategy 5: Micro-Flipping and Wholesaling

Micro-flipping and wholesaling have become popular entry points for real estate entrepreneurs with limited funds.

Instead of buying houses, you focus on finding undervalued deals, securing them under contract, and then selling that contract to investors for a fee.

- Typical profits range from $2,000 to $10,000 per deal

- Costs are minimal — mostly marketing and software tools (like PropStream or Zillow)

Your $5,000 can cover initial expenses like list subscriptions, marketing campaigns, and legal templates.

Note: These strategies require effort and negotiation skills — but not ownership or credit.

8. How to Use Technology to Your Advantage

In 2025, tech makes real estate side hustles easier than ever.

Use these digital tools to maximize results:

- Zillow & Redfin: Research properties and market trends.

- BiggerPockets: Learn from real investors and access calculators.

- Canva & Fiverr: Create marketing materials for your business.

- Google Workspace / Notion: Manage contacts, budgets, and documents.

Automation, data, and AI-driven platforms give small investors the same insights that big institutions use — often for free.

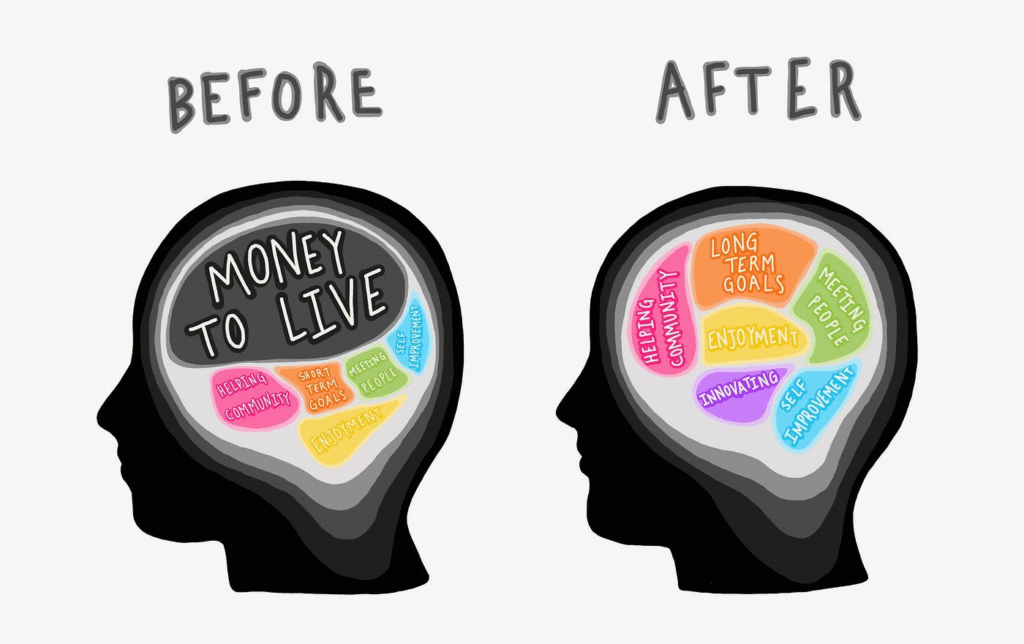

9. Mindset: Think Long-Term, Start Small

The biggest mistake new investors make is expecting overnight success. Real estate rewards patience and discipline.

Use your first $5,000 to:

- Build knowledge

- Gain confidence

- Generate consistent returns

Then, reinvest profits to scale. Within a few years, that small beginning can evolve into a diverse, income-producing portfolio or thriving side business.

10. Final Thoughts

Starting a real estate side business with less than $5,000 isn’t just possible — it’s practical.

Thanks to modern platforms, low-cost business tools, and creative investing options, you can enter the market without massive risk or capital.

Whether you choose REITs, crowdfunding, or service-based ventures, the key is taking action now. The earlier you start, the more time your money — and your experience — have to grow.

Real estate isn’t just about properties.

It’s about ownership, opportunity, and freedom — and in 2025, those are more accessible than ever.