The question of whether to buy or rent has always been a classic financial dilemma. But in 2025, the decision is more complex than ever. With interest rates fluctuating, housing prices stabilizing after years of volatility, and rental costs rising across major U.S. cities, many Americans are wondering: is now the time to buy, or does renting still make more sense?

This article breaks down the pros, cons, and real-world math behind each choice — helping you make the smartest decision for your financial situation.

1. The 2025 Housing Market at a Glance

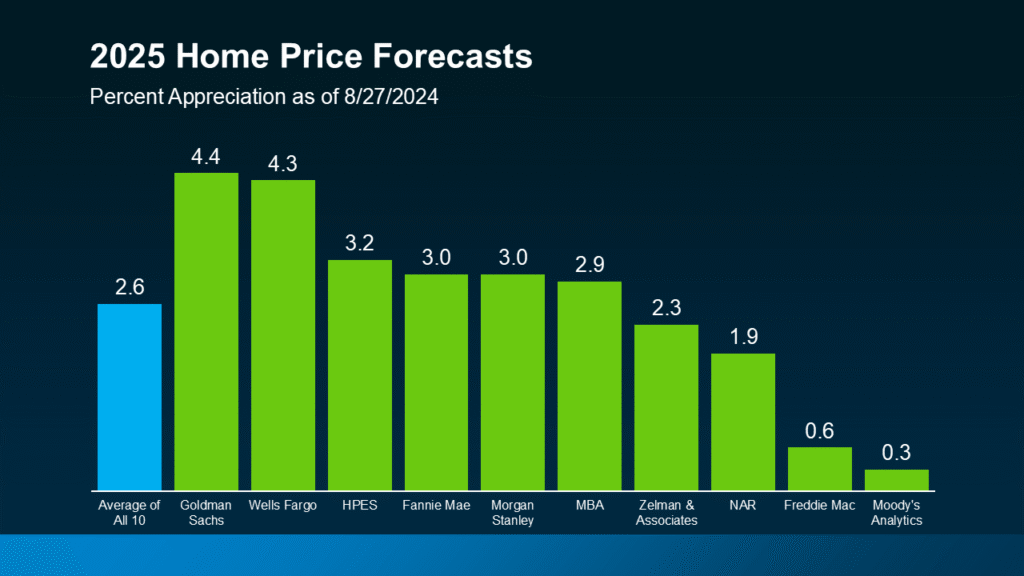

After years of wild swings, the U.S. housing market in 2025 is finally showing signs of stabilization.

According to industry analysts, home prices have plateaued in many major metros, but affordability remains a challenge due to high mortgage rates and limited supply.

- Average 30-year fixed mortgage: around 6.25%–6.75%

- Average home price: approximately $425,000 (down slightly from 2024 peaks)

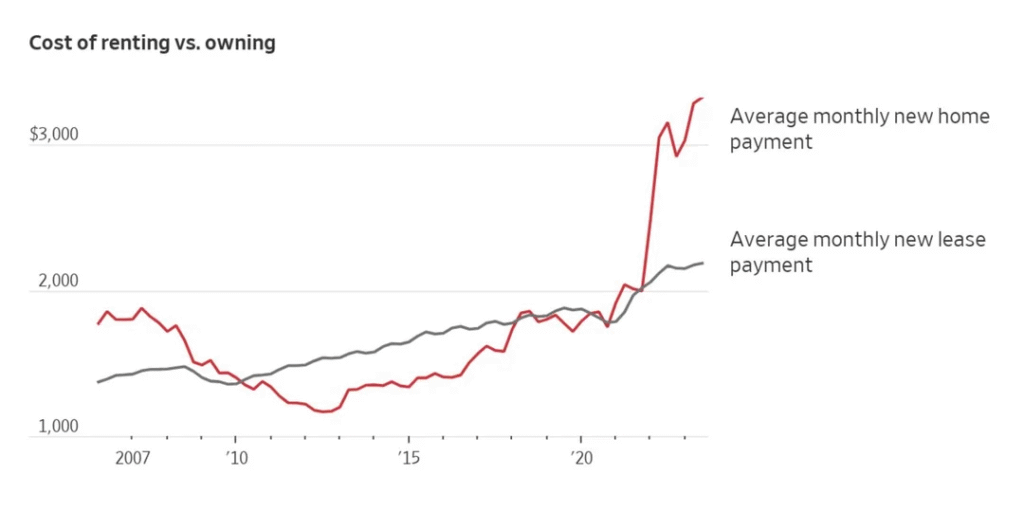

- Rent growth: moderate at 3–4% annually, but still outpacing wage increases in many regions

In short: buying a home is expensive, but renting isn’t cheap either.

2. Buying a Home: The Long-Term Play

Owning real estate remains one of the most reliable paths to wealth — but it’s not for everyone.

Pros of Buying:

✅ Equity Growth

Each mortgage payment builds ownership. Over time, this can lead to significant wealth, especially if property values rise.

✅ Fixed Payments (in the Long Run)

With a fixed-rate mortgage, your principal and interest stay the same for 15–30 years, unlike rent which can increase annually.

✅ Tax Advantages

Homeowners can deduct mortgage interest and property taxes, lowering taxable income.

✅ Stability and Control

You’re not at the mercy of landlords, and you can customize your space freely.

✅ Inflation Hedge

Real estate tends to appreciate during inflationary periods, making homeownership a solid store of value.

Cons of Buying:

⚠️ High Upfront Costs

A down payment (typically 10–20%), closing costs, and moving expenses can total $30,000–$80,000 for an average home.

⚠️ Maintenance and Repairs

Homeowners are responsible for upkeep, which can easily cost 1–2% of property value per year.

⚠️ Market Risk

If housing prices dip, you could owe more than your home is worth — especially if you bought recently with a small down payment.

⚠️ Less Flexibility

Selling a home takes time and money. If you might relocate soon, buying may not make sense.

3. Renting in 2025: The Smart Flexibility Move

Renting gets a bad reputation, but in some situations, it’s the smarter financial and lifestyle choice — especially for younger professionals, remote workers, or those saving for a better deal later.

Pros of Renting:

✅ Lower Upfront Costs

You only need a deposit and first month’s rent — not tens of thousands in down payments.

✅ Mobility

In a rapidly changing job market, flexibility matters. Renting lets you move for new opportunities or lifestyle changes easily.

✅ No Maintenance Headaches

Landlords handle repairs, taxes, and insurance — you just pay rent.

✅ Potential for Better Cash Flow

If renting is cheaper than owning in your area, you can invest the difference elsewhere (stocks, ETFs, or even real estate crowdfunding).

Cons of Renting:

⚠️ No Equity

Your rent payments don’t build ownership. You’re helping someone else pay their mortgage.

⚠️ Rising Costs

Rent hikes can quickly eat into your budget, especially in urban centers like New York, Miami, or Austin.

⚠️ Less Stability

Lease renewals depend on landlords, and eviction risks rise in tight markets.

⚠️ No Tax Benefits

Unlike homeowners, renters don’t receive deductions for housing-related expenses.

4. The Math: Renting vs. Buying Example

Let’s compare two realistic 2025 scenarios:

Buying

- Home price: $400,000

- 20% down payment: $80,000

- Mortgage rate: 6.5% (30 years)

- Monthly mortgage (P&I): ~$2,025

- Property taxes + insurance: ~$500

- Maintenance: ~$250

- Total: ~$2,775/month

Renting

- Comparable rental: $2,200/month

- Rent increases 3% per year

- $0 maintenance, taxes, or insurance

At first glance, renting is cheaper by $575/month. But the buyer is building equity of about $5,000–$6,000 per year, which offsets part of that cost — especially if home values rise modestly (2–3% annually).

5. When Buying Makes More Sense

Buying becomes more advantageous when:

- You plan to stay in the home for 5+ years

- You have a stable job and an emergency fund

- Your mortgage payment is less than 30–35% of your income

- You’re buying in an area with strong job growth or population inflows

In 2025, secondary cities like Raleigh, Tampa, Boise, and Columbus continue to show strong appreciation potential and lower entry costs than coastal metros.

6. When Renting Wins

Renting might be smarter if:

- You expect to move within 3 years

- You don’t have enough saved for a down payment without depleting savings

- Local home prices are significantly higher than rent equivalents

- You prefer financial flexibility or are focusing on investing elsewhere

In expensive metros like San Francisco, Los Angeles, or New York, buying often remains out of reach even for high earners — renting provides breathing room while still allowing wealth building through other investments.

7. The Hybrid Strategy: Rent and Invest

A growing number of Americans are adopting a middle path: rent where you live, buy where it’s affordable.

This means living in a high-cost city but investing in real estate elsewhere through:

- REITs (Real Estate Investment Trusts)

- Fractional real estate apps (like Fundrise or Arrived Homes)

- Out-of-state rental properties managed remotely

You gain exposure to property returns without committing to one location or mortgage.

8. Final Thoughts

In 2025, there’s no universal answer to “buy or rent.”

It all depends on your financial goals, stability, and flexibility needs.

If you value ownership, stability, and long-term wealth, buying is a powerful tool — provided you can afford it comfortably.

If you prioritize freedom, mobility, and cash flow, renting is not a failure — it’s a strategic choice.

The best move? Know your numbers, stay realistic about your timeline, and align your housing decision with your overall financial strategy — not just market trends.

Because in 2025, smart money doesn’t just live in a house — it lives with a plan. 🏠