Money is not just about numbers — it’s about behavior.

No matter how many books you read or strategies you learn, your emotions often decide how you spend, save, or invest. In fact, studies show that over 80% of financial decisions are emotionally driven, not rational.

Understanding the psychology of money is one of the most powerful tools you can develop to achieve long-term financial success. In 2025 — with volatile markets, social pressure, and endless online noise — mastering your mindset is more important than ever.

Why We Don’t Always Act Rationally with Money

Behavioral economists have long argued that humans are predictably irrational when it comes to finances. We often:

- Overspend when we’re happy or stressed

- Panic-sell investments when markets fall

- Delay saving because the future feels distant

This isn’t a flaw — it’s how our brains evolved. We’re wired for short-term survival, not long-term wealth building. Recognizing these emotional biases is the first step toward changing them.

Common Emotional Biases That Affect Your Finances

1. Loss Aversion

We hate losing money more than we enjoy gaining it.

This fear often leads investors to sell too early or avoid investing entirely.

Solution:

Focus on long-term performance rather than short-term volatility. Historically, the U.S. stock market has delivered positive returns over time despite temporary drops.

2. Overconfidence Bias

Many people believe they can “beat the market” — only to underperform due to impulsive trading.

Solution:

Adopt humility. Invest using a diversified strategy, such as ETFs or index funds, and focus on consistency rather than prediction.

3. Herd Mentality

When others start buying or selling, we tend to follow. This herd behavior drove the meme stock frenzy in 2021 and the crypto boom — and bust — that followed.

Solution:

Remember: the crowd is often late. Independent research and patience are your best allies.

4. Anchoring Bias

We fixate on specific numbers — like the price we paid for a stock — and refuse to sell even when logic says otherwise.

Solution:

Reevaluate investments objectively. Your goal is to maximize future value, not justify past decisions.

5. Instant Gratification

It’s easier to buy something today than to save for tomorrow. Social media culture intensifies this impulse by glorifying lifestyle spending.

Solution:

Use automation to make saving and investing effortless. The less you rely on willpower, the more consistent your results will be.

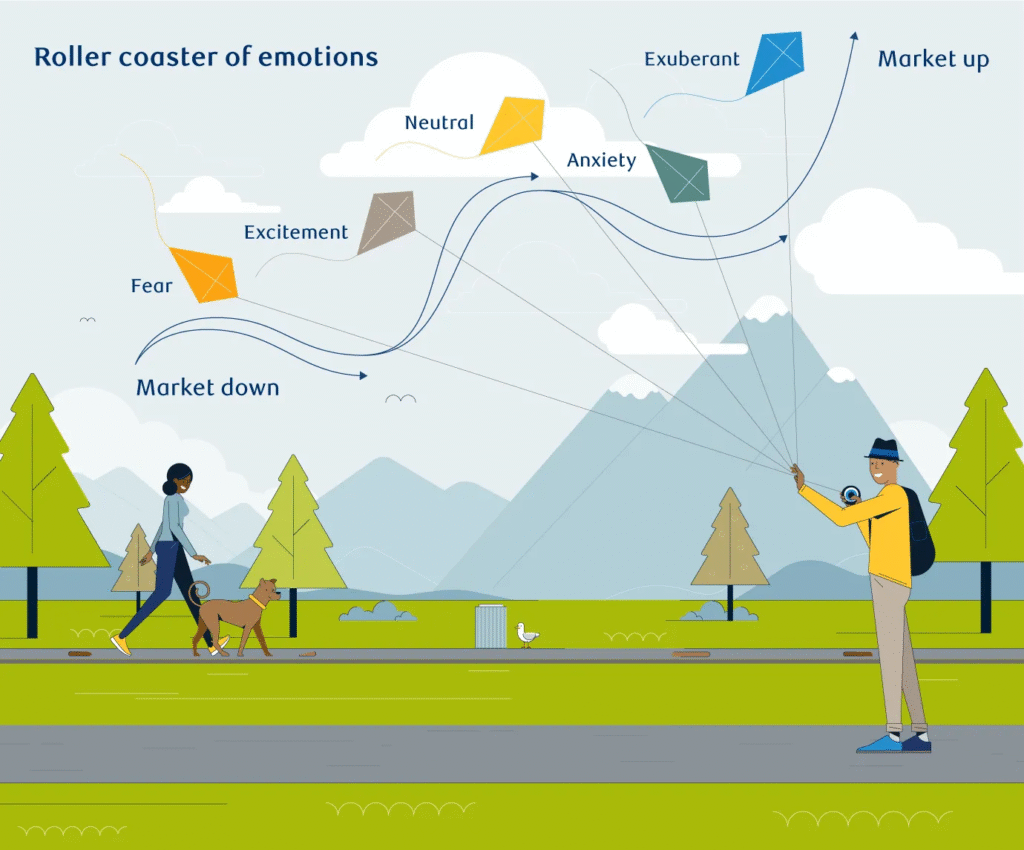

How Emotions Influence Investing

The stock market is a mirror of human emotion — greed and fear move prices more than data does.

When markets rise, greed drives investors to chase returns. When markets fall, fear causes panic selling. This emotional cycle repeats endlessly, leading many to “buy high and sell low.”

Smart investors learn to do the opposite:

- Buy when others are fearful (prices are low).

- Be cautious when others are greedy (prices are high).

Legendary investor Warren Buffett summed it up best:

“The stock market is designed to transfer money from the active to the patient.”

The Role of Financial Mindset

Building wealth is as much mental as mathematical.

A healthy money mindset focuses on progress, not perfection. It means:

- Accepting that mistakes will happen

- Viewing money as a tool, not a measure of worth

- Believing that consistency beats luck

Gratitude, discipline, and patience are as valuable as any financial skill.

Practical Steps to Master the Psychology of Money

1. Create Emotional Distance

When faced with big money decisions, take a 24-hour pause. This helps you think rationally rather than emotionally.

2. Automate Good Habits

Automation removes emotion from the equation. Set up automatic transfers for savings, investments, and bills.

3. Track Your Emotions, Not Just Your Spending

Keep a “money journal.” Note how you feel when you spend, save, or invest. Patterns will emerge — and awareness leads to control.

4. Define Your “Why”

Money decisions are easier when tied to a purpose — financial freedom, family security, or early retirement. A clear “why” keeps you grounded during market turbulence.

5. Learn and Reflect Continuously

Financial growth is lifelong. Read, listen to podcasts, and follow credible experts. The more you understand your biases, the better you can manage them.

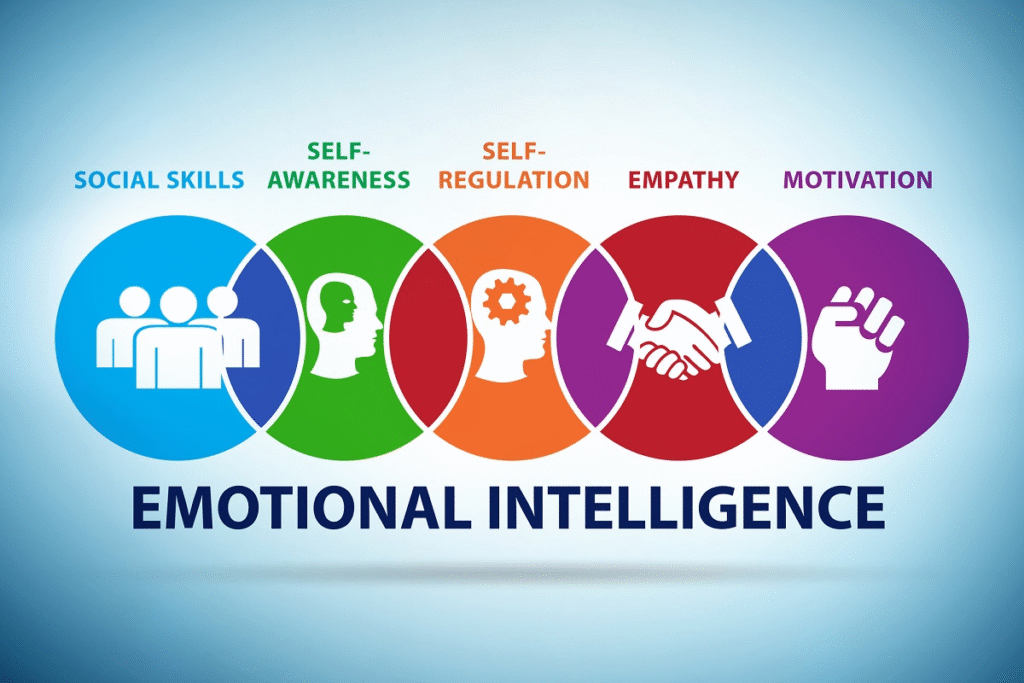

Emotional Intelligence in Financial Relationships

Money is one of the leading causes of stress in relationships.

Couples often argue not because of the amount they have, but because of emotional differences in how they handle it.

Open communication and shared financial goals reduce tension. Discuss budgets, debt, and investments regularly — not just during crises.

How Technology Can Help

In 2025, financial apps are increasingly incorporating behavioral finance tools.

For example:

- Cleo and Monarch Money provide insights into spending psychology.

- Betterment and Wealthfront use automation to reduce impulsive trading.

Using these tools helps you align your actions with your intentions.

Final Thoughts

Financial success isn’t just about income or returns — it’s about emotional mastery.

You can’t eliminate your feelings about money, but you can learn to manage them.

By understanding your biases, automating positive habits, and focusing on long-term goals, you can transform your relationship with money from reactive to strategic.

The real secret to wealth isn’t found in markets — it’s found in mindset.

When you control your emotions, you control your future.