The debate between cryptocurrencies and traditional stocks has reignited in 2025 as investors reassess where to allocate capital in a shifting economic landscape. With inflation stabilizing, interest rates gradually declining, and digital assets rebounding after a turbulent 2022–2023, the choice between crypto and equities is more relevant than ever.

Institutional investors—the so-called “smart money”—are no longer dismissing crypto as a speculative fad. Yet, they also continue to rely on the proven long-term performance of U.S. equities. Let’s explore where the smart money is heading this year and what factors are shaping the balance between these two major asset classes.

1. The 2025 Market Context: Cautious Optimism

In 2025, global markets are entering a new phase. The U.S. economy has avoided a deep recession, inflation has cooled below 3%, and the Federal Reserve is signaling potential rate cuts. Meanwhile, risk appetite is returning across asset classes, from tech stocks to digital currencies.

However, volatility remains. While the S&P 500 continues to post record highs driven by AI and infrastructure investments, crypto markets are experiencing renewed speculative waves—particularly around Bitcoin ETFs and next-generation blockchain projects. The result? A dual narrative of opportunity and caution.

2. Why “Smart Money” Is Still Betting on Stocks

Institutional investors like pension funds, sovereign wealth funds, and hedge funds maintain strong exposure to equities—and for good reason.

a. Proven long-term returns:

Over the last century, the S&P 500 has delivered an average annualized return of about 10%. Even adjusting for inflation, few asset classes rival its stability and compounding power.

b. Transparency and regulation:

U.S. equities operate in a tightly regulated environment, which reduces counterparty and liquidity risks. Companies must publish earnings, audits, and forward guidance, allowing analysts to make informed decisions.

c. The AI revolution:

Many institutional portfolios are overweight in technology, especially in sectors tied to artificial intelligence, semiconductors, and automation. Goldman Sachs projects that AI-related productivity gains could add $7 trillion to global GDP by 2030.

d. Dividends and buybacks:

Unlike crypto, stocks can generate income through dividends and share repurchases. For long-term funds, this makes equities the cornerstone of stable wealth creation.

3. The Growing Institutional Interest in Crypto

Despite the dominance of equities, 2025 is seeing unprecedented institutional participation in digital assets. Bitcoin and Ethereum have matured significantly, with new custodial solutions and clear tax frameworks encouraging adoption.

a. Bitcoin ETFs and regulatory clarity:

The approval of spot Bitcoin ETFs in the U.S. has opened the door for pension funds and endowments to allocate small percentages of their portfolios to crypto exposure. This legitimization has reduced reputational risk and provided a regulated vehicle for investment.

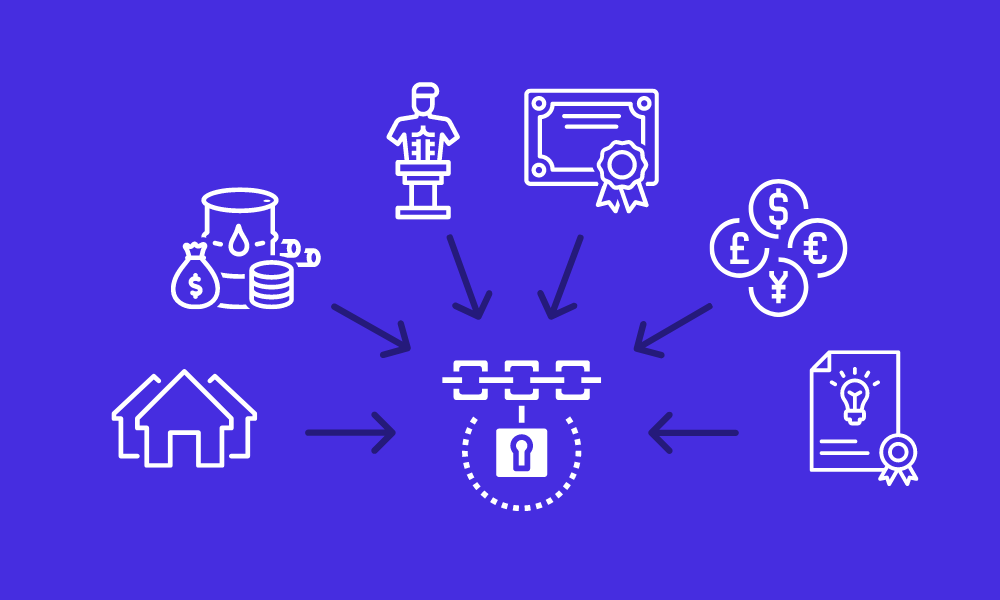

b. Blockchain beyond speculation:

Institutional investors are increasingly viewing blockchain as a foundational technology, not just a speculative asset. From tokenized real estate to supply chain transparency, blockchain’s use cases are expanding.

c. Diversification benefits:

Bitcoin’s long-term correlation with equities remains relatively low. This makes it a valuable hedge in multi-asset portfolios—especially during currency volatility or geopolitical shocks.

4. Comparing Returns: Crypto vs. Stocks

The contrast in returns remains dramatic.

- Bitcoin gained over 150% in 2023 and continued moderate growth in early 2025.

- Ethereum has recovered 80% from its 2022 lows, fueled by DeFi and NFT infrastructure expansion.

- Meanwhile, the S&P 500 returned around 12% in 2024, led by AI and industrial growth.

While crypto offers explosive upside, its volatility is extreme—daily swings of 5% to 10% remain common. Stocks, on the other hand, compound more predictably over decades.

A balanced investor might therefore allocate 90% to equities and 10% to crypto for diversification—enough exposure to capture upside without overextending risk.

5. Key Risks in 2025

Crypto Risks:

- Regulatory uncertainty: Although frameworks are improving, governments can still impose sudden restrictions or taxes.

- Market manipulation: Whales and unregulated exchanges can distort prices.

- Security vulnerabilities: Hacks and smart contract exploits remain a risk.

Stock Market Risks:

- Overvaluation: The S&P 500’s price-to-earnings ratio remains high by historical standards.

- Economic slowdown: If rate cuts are delayed or earnings disappoint, equities could correct.

- Sector concentration: Big Tech now represents over 30% of index weight—creating potential imbalances.

6. The Hybrid Future: Tokenized Equities and Digital Assets

Perhaps the smartest investors aren’t choosing between crypto and stocks—they’re preparing for convergence.

The tokenization of traditional assets is one of 2025’s most exciting trends. Platforms like BlackRock’s digital fund initiatives and JPMorgan’s Onyx blockchain are experimenting with tokenized U.S. Treasuries and equities that trade on blockchain rails.

This hybrid model could combine the transparency of public markets with the efficiency of decentralized technology—creating an entirely new generation of investable assets.

7. Where the Smart Money Is Moving

According to Fidelity and Goldman Sachs’ institutional surveys, most professional investors in 2025 are adopting a “barbell strategy”:

- Core holdings: 80–90% in equities, focused on U.S. large caps, AI, and energy transition plays.

- Alternative exposure: 5–15% in Bitcoin, Ethereum, and tokenized assets for growth and diversification.

This balanced approach reflects both prudence and innovation—embracing the best of traditional finance while positioning for the digital future.

Final Thoughts

Crypto and stocks are no longer opposing forces—they’re complementary vehicles for wealth creation. In 2025, smart investors recognize that diversification is the real alpha.

Stocks offer stability, dividends, and compounding. Crypto brings growth potential and technological disruption. Together, they represent the new frontier of modern investing—where tradition meets innovation, and the winners are those who master both worlds.