As artificial intelligence continues to dominate headlines and reshape industries, investors are asking a critical question: What comes after NVIDIA?

While NVIDIA’s dominance in AI chips has been undeniable, the landscape is expanding rapidly — and a new wave of companies is positioning itself to capture the next stage of growth in AI hardware, software, and applications.

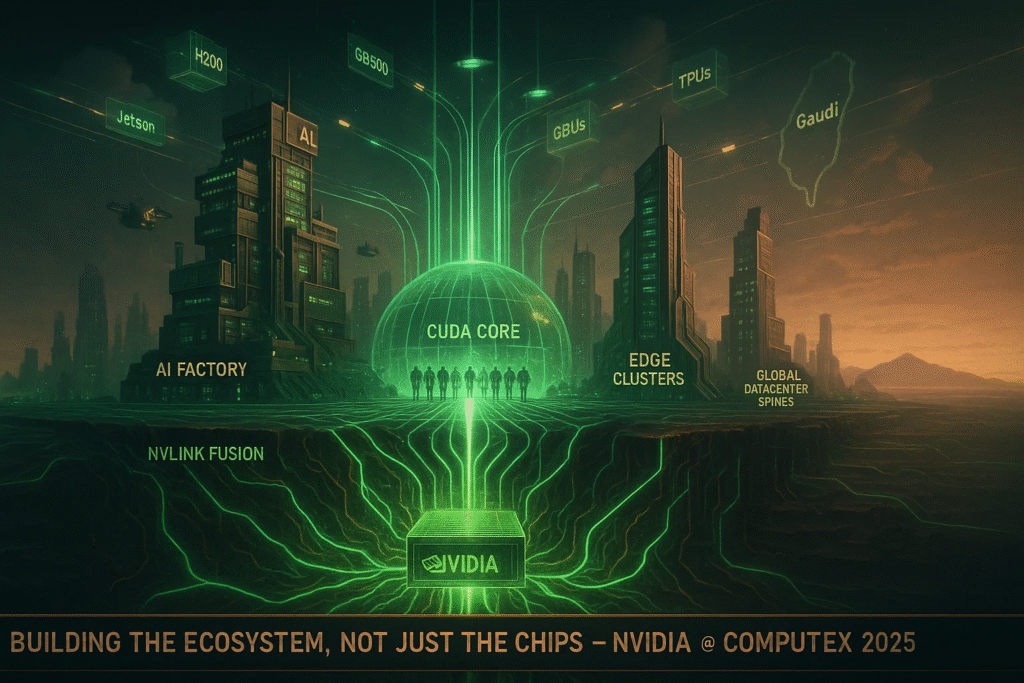

1. The AI Ecosystem Is Broader Than GPUs

The AI economy has matured far beyond graphics processing units (GPUs). The next generation of winners will likely come from AI infrastructure providers, data management firms, cloud platforms, and specialized software developers. As AI adoption accelerates, the demand for complementary technologies — from power-efficient chips to data analytics tools — is creating vast opportunities for innovative players.

2. Advanced Micro Devices (AMD): The Challenger Gains Momentum

AMD (NASDAQ: AMD) has emerged as NVIDIA’s most credible rival in AI chips. With its MI300 series of AI accelerators, AMD has started securing design wins with major cloud providers such as Microsoft Azure and Oracle Cloud. Analysts expect AMD’s data center revenue to grow by over 40% in 2025, driven largely by AI demand.

While NVIDIA still leads in software ecosystems (CUDA), AMD’s open-source ROCm platform is gaining traction among developers. If the company continues to expand its partnerships and improve AI chip performance, it could close the gap further by 2026.

Risks: NVIDIA’s dominant software moat and higher R&D spending remain strong barriers to entry. AMD must also navigate intense price competition and supply chain constraints.

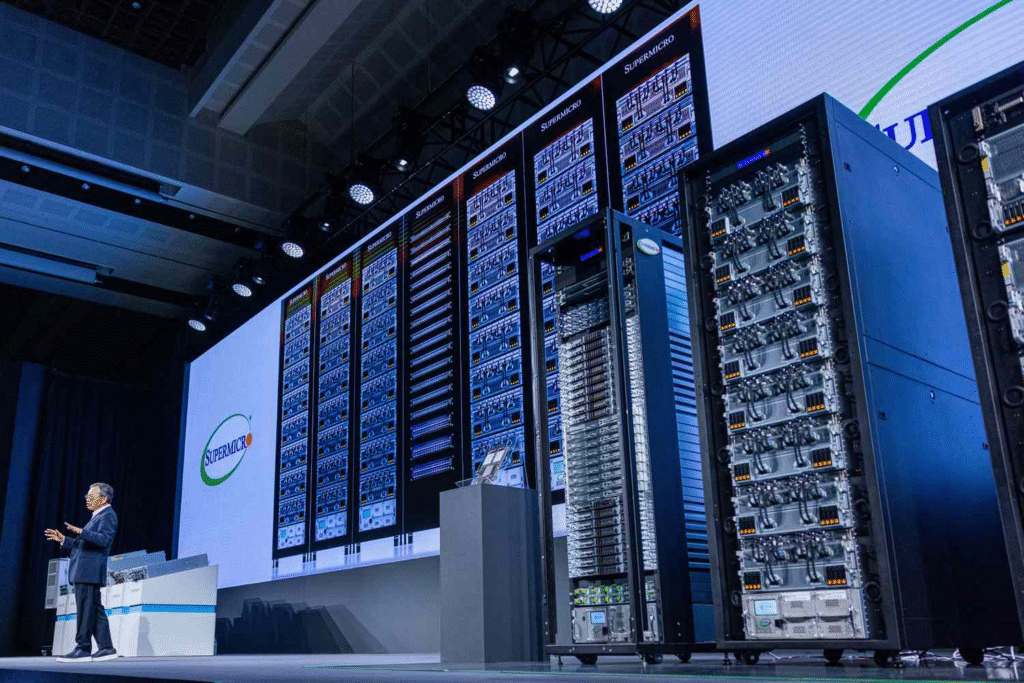

3. Super Micro Computer (SMCI): The Infrastructure Powerhouse

Super Micro Computer (NASDAQ: SMCI) has been one of the fastest-growing AI infrastructure providers, designing high-performance servers optimized for AI workloads. Its ability to rapidly customize hardware for large clients like Meta and Tesla has made it a key player in the AI buildout.

In fiscal 2025, analysts project SMCI’s revenue to grow over 30%, fueled by demand from cloud providers expanding their AI clusters. The company’s efficient supply chain and modular design approach give it an edge over traditional server manufacturers.

Risks: Dependence on large hyperscale customers could expose SMCI to cyclicality in capital expenditures.

4. Palantir Technologies (PLTR): Turning Data Into Intelligence

Beyond hardware, Palantir (NYSE: PLTR) represents one of the most compelling software plays in AI. The company specializes in transforming vast amounts of data into actionable insights for governments and corporations. Its Artificial Intelligence Platform (AIP) is being rapidly adopted by enterprises seeking to integrate generative AI into decision-making processes.

Palantir’s expansion into the commercial sector and partnerships with major institutions (including the U.S. Army and NHS) give it a strong growth pipeline. Analysts expect revenue to grow 20–25% annually through 2026.

Risks: Valuation remains stretched, and the company’s reliance on government contracts could expose it to regulatory or political headwinds.

5. ASML Holding (ASML): The Critical Supplier of AI Chips

No AI chip can be manufactured without ASML’s lithography machines. The Dutch semiconductor equipment giant is the only company capable of producing extreme ultraviolet (EUV) systems, essential for fabricating cutting-edge chips.

With the AI boom driving semiconductor expansion, ASML’s technology is indispensable. Even as chipmakers diversify globally, ASML remains a bottleneck in the global supply chain — a position of immense strategic importance.

Risks: Export restrictions to China and slowing capital spending by chipmakers could limit short-term growth, though long-term fundamentals remain strong.

6. Snowflake (SNOW): Data Is the Fuel for AI

AI depends on vast, organized, and high-quality data — and that’s exactly where Snowflake (NYSE: SNOW) shines. Its cloud-based data platform allows businesses to centralize and analyze information across multiple sources, making it a natural beneficiary of AI-driven transformation.

In 2025, Snowflake is focusing on integrating machine learning models directly into its platform, allowing customers to train and deploy AI without complex infrastructure. Analysts expect usage-based revenue to rebound as enterprise AI adoption scales.

Risks: High valuation and slowing consumption growth in 2024 raised investor concerns, but improving cloud spending trends may offset that.

7. Thematic ETFs: Broad Exposure to AI Growth

For investors who prefer diversification, AI-focused ETFs such as the Global X Robotics & Artificial Intelligence ETF (BOTZ) or iShares Robotics and Artificial Intelligence ETF (IRBO) offer exposure to a curated basket of AI innovators. These ETFs include semiconductor, software, and automation companies across global markets.

8. The Road Ahead

The AI revolution is far from over — it’s evolving from infrastructure to application. While NVIDIA remains a cornerstone of AI exposure, the next generation of winners will likely emerge from companies enabling faster computation, smarter software, and more efficient deployment.

From AMD’s chip innovation to Palantir’s software intelligence and Snowflake’s data integration, the AI value chain is expanding — offering investors multiple entry points. The key for 2025 and beyond will be identifying companies with sustainable competitive advantages, scalable business models, and prudent capital management.

In short: NVIDIA may have started the AI gold rush, but the next billion-dollar opportunities are already taking shape — just a layer deeper in the stack.NVIDIA Announces Financial Results for First Quarter Fiscal 2026