Monthly budgeting is often presented as a strict system of rules, spreadsheets, and discipline. In reality, effective budgeting is less about control and more about clarity. For beginners in the United States, understanding how money flows month to month is the first step toward financial stability.

This guide explains monthly budgeting in a realistic and sustainable way, without relying on extreme restrictions or unrealistic assumptions.

Why Monthly Budgeting Matters in the U.S.

The U.S. financial system places a high level of responsibility on individuals. Housing costs, healthcare expenses, insurance premiums, and variable taxes can make cash flow unpredictable.

Monthly budgeting helps by:

- Creating visibility into spending

- Reducing reliance on credit

- Supporting consistent saving habits

- Lowering financial stress

A budget is not meant to limit your lifestyle. It is meant to support it.

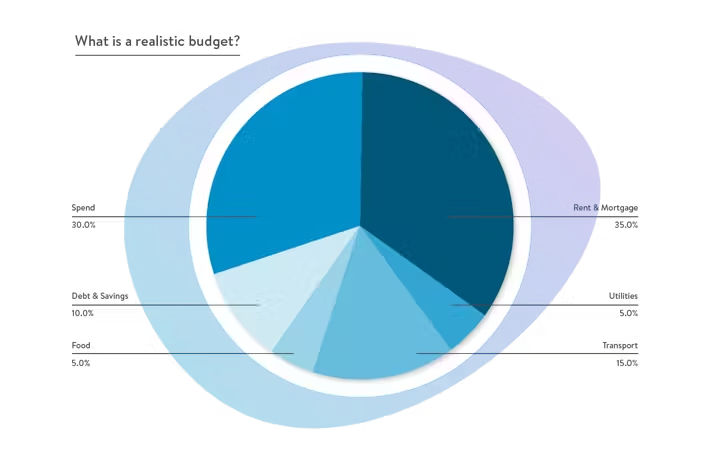

What a Monthly Budget Really Is

At its core, a monthly budget is simply a plan for how income will be used over a defined period. It does not require perfection, and it does not require cutting all discretionary spending.

A practical budget includes:

- Fixed expenses

- Variable expenses

- Savings

- Flexibility

The goal is awareness, not control.

Step 1: Understand Your Monthly Income

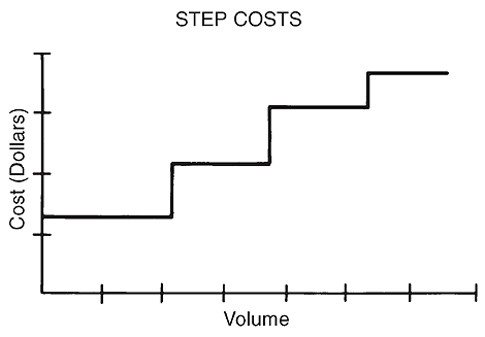

For salaried employees, income is often predictable. For hourly workers, freelancers, or contractors, income may fluctuate.

When income varies, using a conservative monthly estimate based on historical averages is often more effective than using best-case numbers.

This approach reduces the risk of overcommitting funds.

Step 2: Identify Fixed Expenses

Fixed expenses are costs that remain relatively stable each month. Common examples include:

- Rent or mortgage payments

- Utilities

- Insurance

- Phone and internet

- Minimum debt payments

These expenses form the foundation of any budget and should be prioritized.

Step 3: Track Variable Spending

Variable expenses tend to be underestimated. These include:

- Groceries

- Dining

- Transportation

- Entertainment

- Personal spending

Tracking actual spending for at least one month provides valuable insight and prevents unrealistic budgeting assumptions.

Step 4: Build Savings Into the Budget

Savings should be treated as a planned expense, not an afterthought. Even small amounts contribute to long-term stability.

Common savings categories include:

- Emergency fund

- Short-term savings

- Long-term goals

In the U.S., high-yield savings accounts are often used for this purpose due to accessibility and safety.

Step 5: Allow for Flexibility

Rigid budgets often fail. Life events, unexpected expenses, and seasonal costs are unavoidable.

A flexible budget includes buffer space to absorb variability without derailing the entire plan.

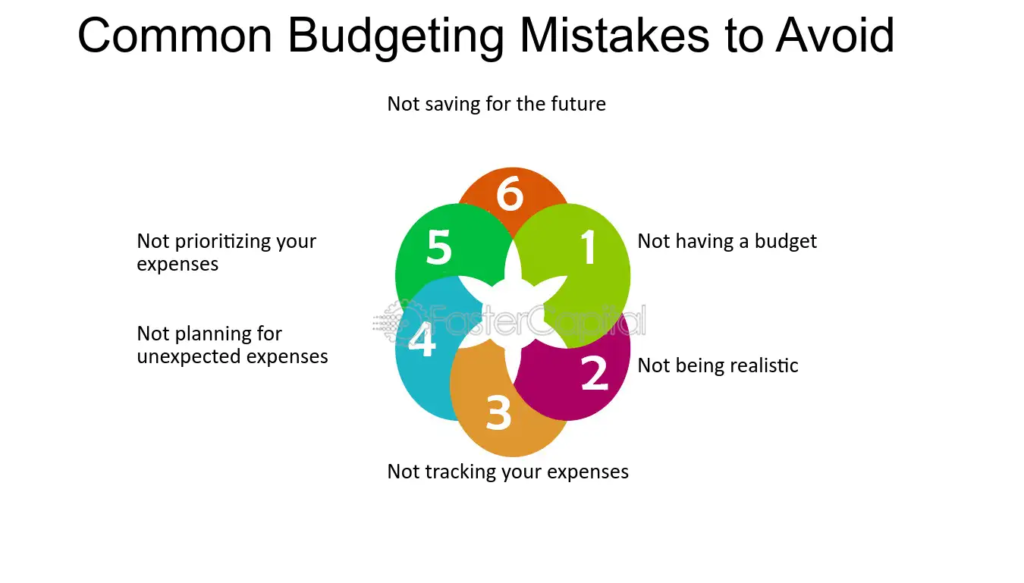

Common Budgeting Mistakes Beginners Make

Some of the most common mistakes include:

- Underestimating variable expenses

- Forgetting irregular costs

- Setting unrealistic savings goals

- Treating budgeting as punishment

Effective budgeting evolves over time.

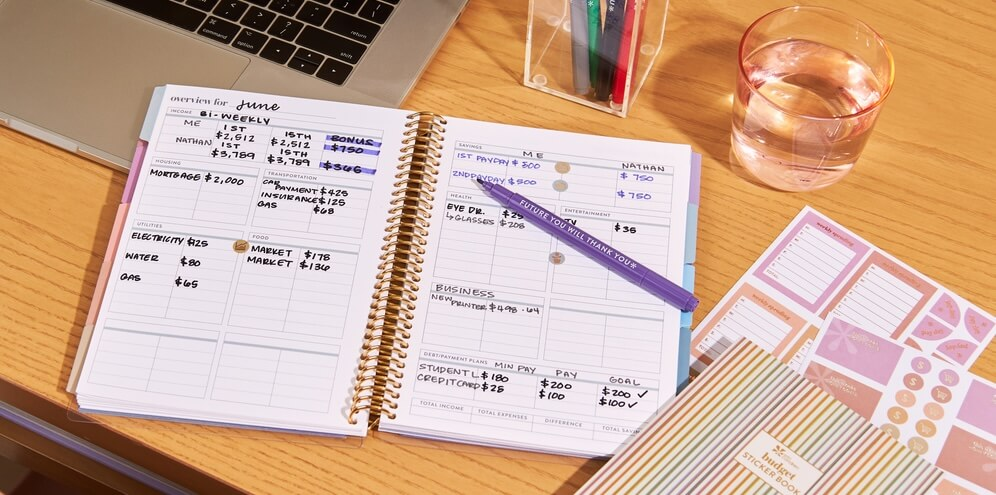

Tools vs. Habits

Apps and spreadsheets can help, but habits matter more. Reviewing a budget weekly or biweekly often produces better results than complex systems reviewed monthly.

Adjusting Your Budget Over Time

Budgets should change as income, expenses, and priorities evolve. Reviewing and adjusting regularly keeps the budget relevant and effective.

Final Thoughts

Monthly budgeting is not about perfection. It is about awareness and intention.

For beginners in the U.S., a simple and flexible monthly budget is one of the strongest tools for building long-term financial confidence and stability.