Cash flow is one of the most overlooked aspects of personal finance. Many people focus on income level or net worth, yet still experience financial stress due to poor cash flow management.

In the United States, where expenses and income timing often vary, understanding cash flow is essential for financial stability.

What Cash Flow Means in Personal Finance

Cash flow refers to the movement of money in and out of your accounts over time. Positive cash flow means more money is coming in than going out. Negative cash flow means expenses exceed income.

Managing cash flow is not about earning more money, but about timing, structure, and awareness.

Why Cash Flow Problems Are So Common

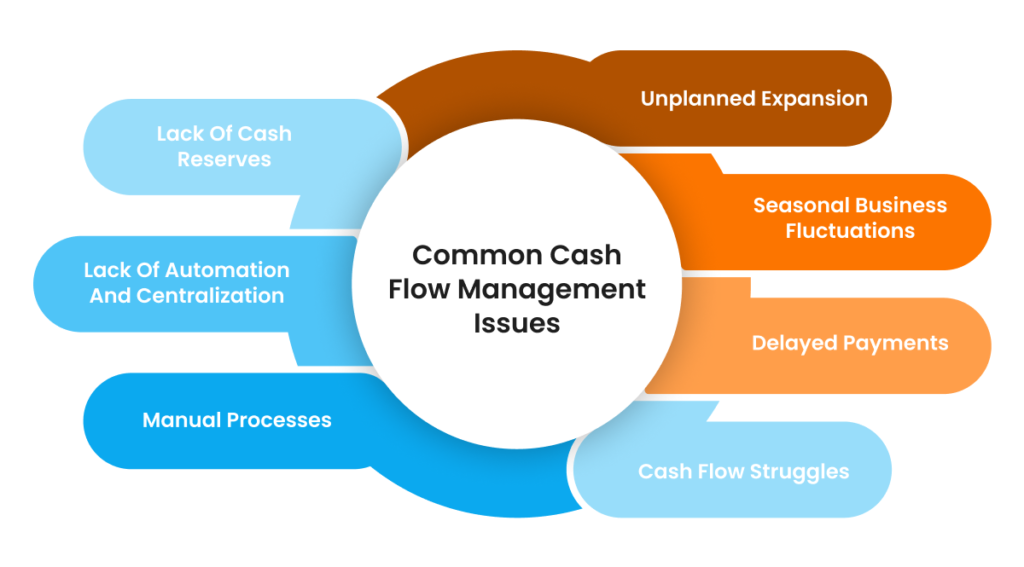

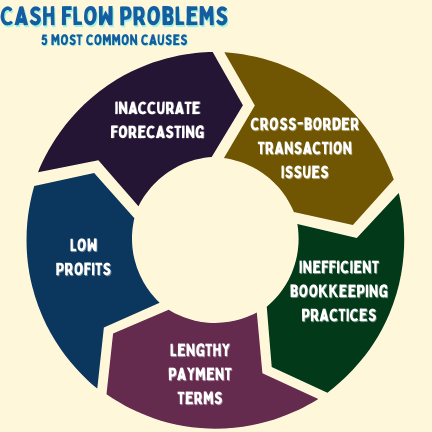

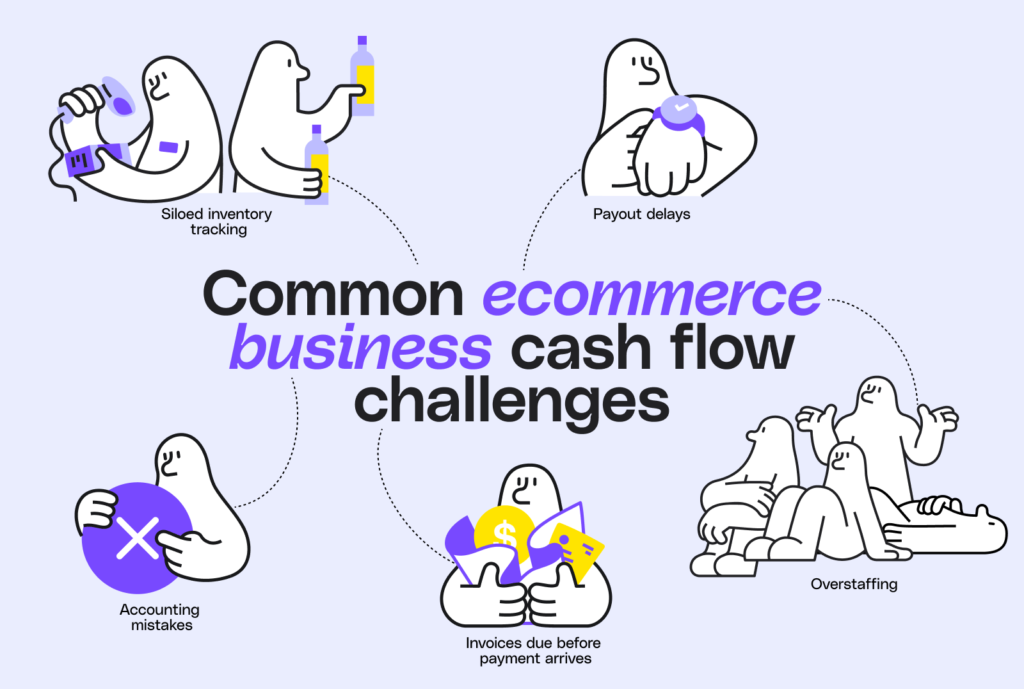

Cash flow issues often arise from:

- Irregular income

- Poor expense timing

- Lack of savings buffers

- Overreliance on credit

Even high-income households can struggle if cash flow is mismanaged.

Step 1: Map Your Income Timing

Understanding when income arrives is critical. Many expenses are fixed to calendar dates, while income may arrive biweekly or irregularly.

Aligning expenses with income timing reduces stress and overdraft risk.

Step 2: Identify Cash Flow Pressure Points

Pressure points are moments when expenses cluster. Examples include:

- Rent combined with insurance payments

- Annual subscriptions

- Medical bills

Recognizing these patterns allows for better preparation.

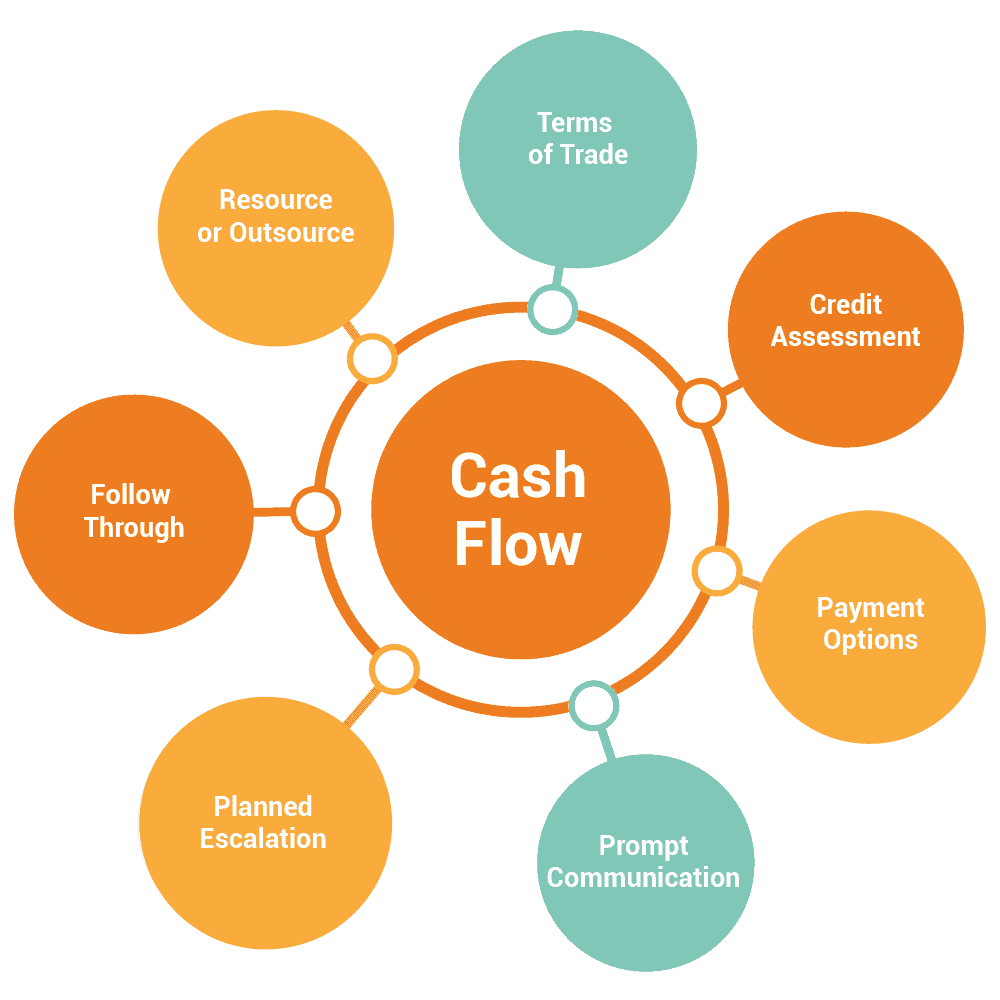

Step 3: Separate Cash Buckets

A common cash flow strategy involves separating money into distinct buckets:

- Spending account

- Savings account

- Emergency fund

This structure reduces accidental overspending and improves clarity.

Step 4: Use Savings as a Buffer, Not a Crutch

Savings should smooth cash flow, not replace it. Regularly relying on savings to cover routine expenses signals a structural issue.

Adjusting spending or timing is often more effective than constant transfers.

Step 5: Build a Cash Flow Cushion

A cash flow cushion is different from an emergency fund. It exists to manage timing mismatches, not emergencies.

Even one month of expenses can significantly reduce stress.

Common Cash Flow Mistakes

Some frequent mistakes include:

- Ignoring small recurring expenses

- Paying bills without regard to timing

- Treating credit as income

- Failing to review cash flow regularly

These issues compound over time.

Cash Flow and Financial Confidence

Strong cash flow management improves decision-making. It allows individuals to plan ahead rather than react to financial surprises.

This confidence often leads to better long-term financial outcomes.

Adjusting Cash Flow as Life Changes

Life events such as job changes, relocation, or family growth require cash flow adjustments. Regular reviews ensure systems remain aligned.

Final Thoughts

Cash flow management is not complicated, but it requires attention.

In personal finance, especially in the U.S., mastering cash flow is one of the most effective ways to reduce stress and build sustainable financial stability.