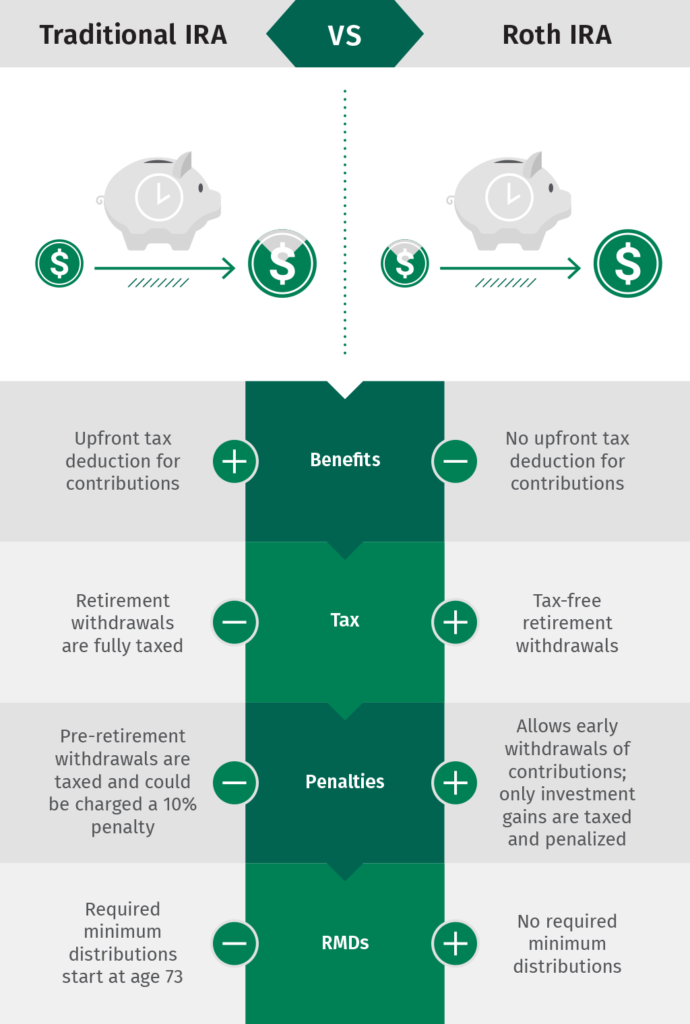

Choosing between Traditional and Roth retirement accounts is one of the most common questions in U.S. personal finance. While the concepts are often presented as complex, the core difference is straightforward: when you pay taxes.

Understanding this difference helps clarify which option may better support long-term financial goals.

The Core Difference: Tax Timing

Traditional accounts generally provide tax benefits today, while Roth accounts provide tax benefits in the future.

This distinction influences how retirement income is taxed and how flexible withdrawals can be later in life.

How Traditional Retirement Accounts Work

Traditional retirement accounts allow contributions to be made before taxes in many cases. This can reduce taxable income in the contribution year.

Taxes are paid when money is withdrawn during retirement.

Benefits of Traditional Accounts

Common advantages include:

- Immediate tax reduction

- Higher take-home pay today

- Useful for current high earners

However, withdrawals are taxed as ordinary income later.

How Roth Retirement Accounts Work

Roth accounts are funded with after-tax dollars. There is no tax deduction upfront.

Qualified withdrawals in retirement are tax-free, offering long-term tax certainty.

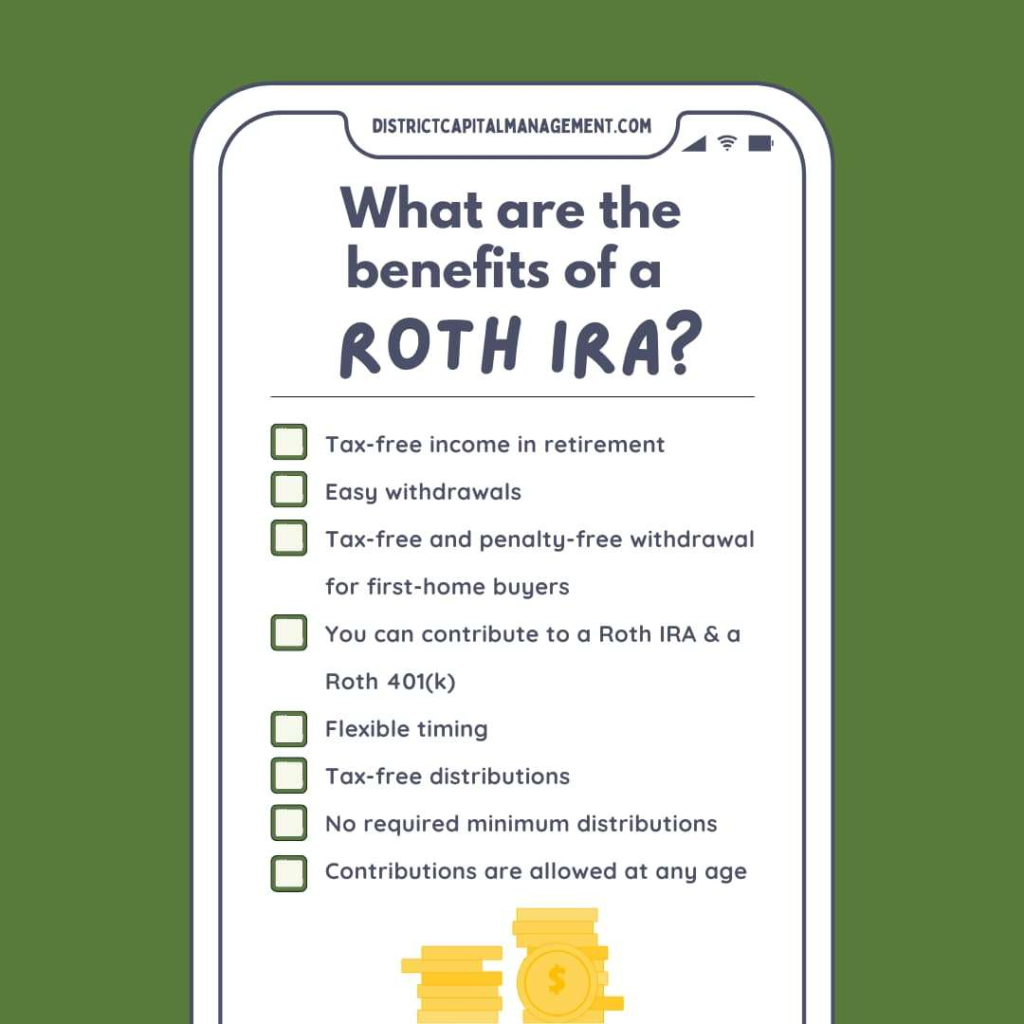

Benefits of Roth Accounts

Advantages often include:

- Tax-free retirement income

- No tax impact from future rate changes

- Greater planning flexibility

Roth accounts can be particularly valuable for long-term planning.

Common Misunderstandings

Many people assume one option is universally better. In reality, suitability depends on:

- Current income

- Expected future income

- Tax rate assumptions

- Time horizon

Why Many U.S. Savers Use Both

Using both Traditional and Roth accounts can provide tax diversification. This allows flexibility when managing retirement withdrawals.

Diversification reduces reliance on a single tax outcome.

The Importance of Long-Term Perspective

Short-term tax savings can be appealing, but long-term consequences matter more. Retirement planning benefits from evaluating future scenarios rather than focusing solely on the present.

Reviewing Retirement Strategy Periodically

Life changes, income shifts, and tax laws evolve. Reviewing account types periodically helps maintain alignment with goals.

Final Thoughts

Traditional and Roth retirement accounts are tools, not decisions in isolation. Understanding how each works allows for more informed and confident planning.

In U.S. personal finance, tax timing is often more important than tax rates themselves.